How to Clean Adidas Suede Shoes

Adidas suede shoes are not only comfortable and stylish but also require proper maintenance to keep them looking new. Suede shoes can get easily stained, watermarked or discolored, which can be challenging to remove. Therefore, it’s essential to know how to clean your Adidas suede shoes to keep them in their pristine condition. In this…

Read More

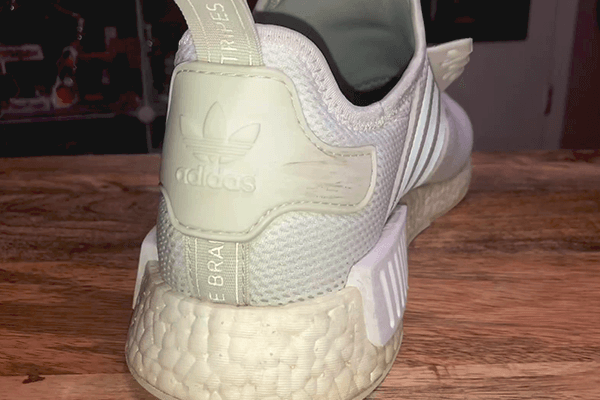

How to Clean White Adidas NMD

Adidas NMD has been one of the most popular athletic shoes in recent years. The sports brand has launched many different versions of the shoes, but the white NMD is a classic that will never go out of style. However, keeping the white NMD clean can be a challenge. Dirty soles, stains, and discoloration can…

Read More

How to Clean Balenciaga Runners

Balenciaga runners are a popular choice for those looking for a stylish and comfortable sneaker. However, just like any other footwear, they require some maintenance to keep them in tip-top shape. When it comes to cleaning Balenciaga runners, it’s important to approach the task with care and precision, so as not to damage the delicate…

Read More

How to Clean Deer Head Mounts

Deer hunting is a popular outdoor sport that offers a sense of thrill and satisfaction. But, the excitement doesn’t end there. Once the hunt is over and the deer head mount is up on the wall, it becomes an artistic expression of the hunter’s success. However, deer head mounts can get dusty, dirty, and fade…

Read More

How to Clean Yeezy Slides

Yeezy slides are a fashion statement, but they are also comfortable and practical footwear that can be worn almost everywhere. Whether you use them to lounge at home or wear them to complete your stylish outfits, Yeezy slides add some swag to your fashion game. However, like any other footwear, Yeezy slides can become dirty…

Read More

How to Clean the Tongue of Shoes

When it comes to keeping your shoes in top condition, it’s important not to forget about the tongue. Many people overlook this crucial part of their footwear, but it’s actually one of the most important areas to keep clean. Not only does a dirty tongue make your shoes look unkempt, it can also harbor bacteria…

Read More

How to Clean Pit Viper Sunglasses

Pit Viper sunglasses are one of the most popular brands of sunglasses. These sunglasses are widely loved for their unique style and unmatched durability, making them the go-to choice for any outdoor activity. However, with prolonged use, Pit Viper sunglasses are likely to get dirty and require cleaning. But cleaning them with harsh chemicals may…

Read More

How to Clean Nike Air Max 97

Nike Air Max 97 is a popular sneaker that combines style with comfort. But with time, its white leather upper and translucent air bubble may lose their shine and start accumulating dirt, dust, and stains. Fortunately, keeping your Nike Air Max 97 clean is not rocket science. You just need a few simple household items,…

Read More

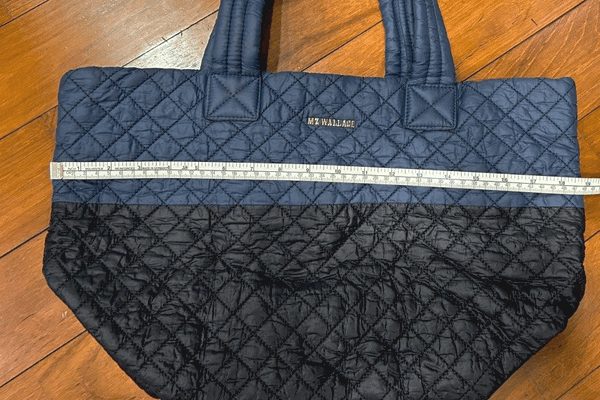

How to Clean MZ Wallace Bags

MZ Wallace bags have gained a reputation for their stylish and versatile designs, but did you know they are also water and stain-resistant? This makes them an ideal bag to tote around in any weather. However, like all other bags, your MZ Wallace bag inevitably gets dirty and needs to be cleaned. But, you must…

Read More

How to Clean Suede Saddle Seat

If you are a horse rider, then you know how important a good saddle seat is. It provides the ultimate comfort and security while riding your horse. But with time and use, this saddle seat can get dirty, especially if it is suede. Suede is a delicate material that requires special attention when it comes…

Read More